Do you know what the P/E of Tribhovandas Bhimji Zaveri Limited (Nse: Tbz) means? nse: tbz Tribhovandas Bhimji Zaveri Limited TBZ RSI Indicator, nse: tbz Limited TBZ Indikatoren RSI technische Analyse, Tribhovandas Bhimji Zaveri Limited TBZ Indikatoren RSI kostenlose Charts, Tribhovandas Bhimji Zaveri Limited TBZ Indikatoren RSI historische Werte nse: tbz

Would you like to participate in a short research study? Help shape the future of investing tools and win a $250 gift certificate!

This article is written for those who want to use price-earnings (P/E) ratios better. Let’s look at the P/E of Tribhovandas Bhimji Zaveri Limited (nse: tbz) and consider what it tells us about the company’s share price. Based on the last twelve months, the P/E of Tribhovandas Bhimji Zaveri is 18.11. That equates to a return on earnings of around 5.5%.

Table of Contents

How do I calculate a price-earnings ratio?

The formula for the price-earnings ratio is:

Price to earnings ratio = stock price ÷ earnings per share (EPS)

Or for Tribhovandas Bhimji Zaveri:

P/E of 18.11 = ₹42.2 ÷ ₹2.33 (based on the last twelve months up to March 2019).

Is a high price-benefit ratio good?

A higher price-earnings ratio means that investors pay a higher price for every pound of earnings from the company. That’s not necessarily a good or bad thing, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Growth Rates Affect P/E

The P/E primarily reflects market expectations for earnings growth rates, and that’s because companies that increase earnings per share quickly will increase the “E” in the equation soon. And in that case, the P/E ratio itself will drop relatively quickly. So a lower P/E ratio should attract more buyers and increase the stock price.

nse: tbz has seen his earnings per share fall 27% over the past year. And it has reduced its earnings per share by 22% per year for the past five years. That growth rate could justify a below-average P/E ratio.

How does Nse: Tbz P/E compare to his peers?

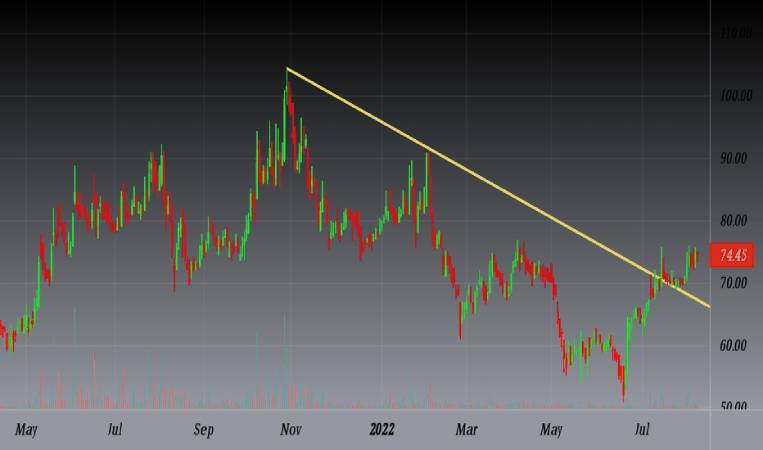

An excellent way to get a quick idea of what market participants expect from a company is the P/E ratio. The image below shows that nse: tbz has a lower P/E than the average P/E (29.6) of companies in the specialty retail industry.

This indicates that market participants believe Tribhovandas Bhimji Zaveri will outperform other companies in its industry. Many investors like to buy stocks when the market is pessimistic about their prospects. It’s probably worth checking to see if insiders are buying stocks, as it could mean they think the stock is undervalued.

Remember: P/E ratios don’t take the balance sheet into account.

A disadvantage of using a price-to-earnings ratio is that it considers the market cap, not the balance sheet. So it won’t reflect the advantage of cash or the disadvantage of debt. The very same company would hypothetically earn a higher P/E if it had a strong balance sheet than if it had a weak one with a lot of debt because a liquidated company can invest in growth.

Such spending can be good or bad over the long term, but the point here is that this ratio doesn’t reflect the bottom line.

How Does Tribhovandas Bhimji Zaveri’s Leverage Affect P/E?

Tribhovandas Bhimji Zaveri has a net debt of 201% of its market cap. If you want to compare the P/E ratio to other companies, you must remember that this debt level would typically justify a relatively low P/E ratio.

The P/E Conclusion of Nse: Tbz

Tribhovandas Bhimji Zaveri’s P/E ratio is 18.1, ahead of the IN market average (15.7). With relatively high levels of debt and no 12-month earnings per share growth, it’s safe to say that the market expects the company to improve its earnings growth going forward.

Investors have an opportunity when market expectations about a stock are wrong. People often underestimate remarkable growth – this is how investors can make money when rapid growth isn’t fully appreciated. So, this free visual report on analyst forecasts could be the key to making a great investment decision.

Of course, you could find a fantastic investment by looking at a few good candidates. So look at this free list of companies with modest (or no) debt trading under 20 times earnings.

We aim to provide you with long-term focused research analysis based on fundamental data. Our study may not consider the latest price-sensitive company announcements or qualitative material.